10 Common Crypto Scams And How to Avoid Them in 2024 – The world of cryptocurrencies , with its anonymity and decentralized nature, attracts various types of scams. Among the most common arefake investments, romance scams, Ponzi schemes and phishing.

What are the most common crypto scams in the world of cryptocurrencies?

Fake investments often come in the form ofpromises of high returns with little risk, while romance scams exploit online relationships to extract funds.

Ponzi schemes, on the other hand, rely on bringing in new investors to pay old ones, and inevitably end up collapsing.

A notorious example of fake investing is thefake Trading Botsof Antares Trade and AutoTrade Gold , projects that promised high returns but turned out to be massive scams.

In the caseof romance scams, hackers createfake profileson dating sites and, after establishing a relationship of trust, persuade their victim to invest in fraudulent cryptocurrencies.

Table of Contents

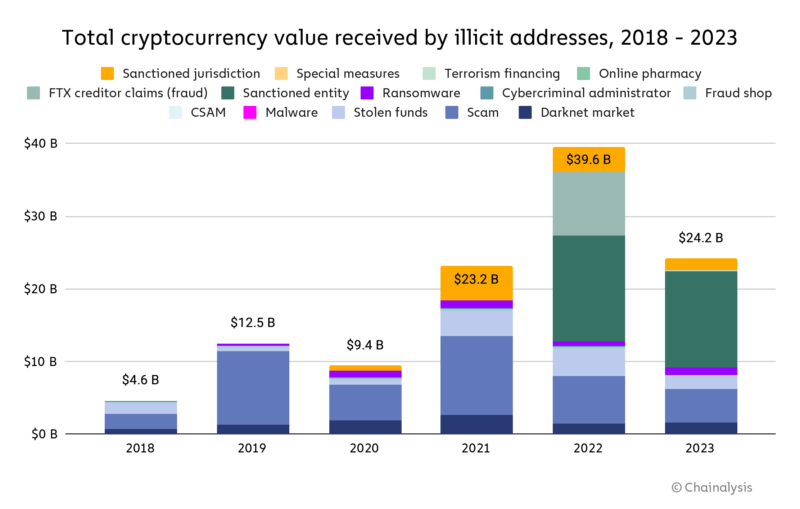

A look back at the evolution of illicit flows in Crypto for 2023

The year 2023 marked a turning point for the world of cryptocurrencies, a period of rebirth after the turbulence and scandals of 2022 . As crypto assets regain value and market activity intensifies, many suggest thatthe crypto winter is coming to an end, potentially heralding a new phase of growth.

According to a study by Chainalysis, the value received by illicit cryptocurrency addressesfell significantly in 2023, reaching $24.2 billion. However, these figures represent only aminimum estimate, based on inbound flows to currently identified illicit addresses.

These totals will most likely increase in the coming years asmore illicit addresses are discoveredand their historical activity is incorporated into our assessments. For example, when the Crypto Crimes Report was released last year, the volume of illicit transactions for 2022 was estimated at $20.6 billion. Today, that estimate has beenrevised to $39.6 billion.

This increase is mainly explained by the identification of previously unknown addresses that are very active and hosted bysanctioned services, as well as the addition of transaction volumes associated with services in sanctioned jurisdictions.

Top 10 Most Common Crypto Scams

We will now review in this guidethe 10 most common scamsin the world of cryptocurrencies, providing you with the indicators to spot and identify them, in order to help youstay away from crypto scamsand protect your investments.

Phishing: Beware of Fake Hooks

Phishing is the art of digital deception that has endured throughout the ages of the Web. You check your emails, and suddenly, an alert from a cryptocurrency platform informs you of a suspicious connection attempt. Or, on social networks, a private message announces that you have been selected for a special offer.

These messages seem legitimate, but make no mistake, they are often the front stageof a well-established trap. They redirect you to mirror sites where, under the pretext of security, you are asked for your login details and, even worse, your private keys.

These scams are more common than you think. Take, for example, this replica of theMyEtherWalletsite that caused havoc, tricking users into stealing their Ethereum. Or those famousgiveaways on Twitterwhere, under the guise of generosity, you are asked to send a little of your crypto with the promise of a double return – which, of course, never happens.

So how can you protect yourself against this crypto scam?

Above all, keep your cool and resist the urge. Skeptically examinethe sender’s address and links included in the message. Enable two-factor authentication(2FA)wherever it is available to strengthen your security.

If in doubt, prefer direct access to the official site rather than following a potentially malicious link. And remember, your private keys should remain asprivateas your most intimate thoughts: no sharing, under any circumstances.

Phishing may seem like an old scammer’s trick, but with the right staging, it can still surprise you. So becarefuland don’t let appearances deceive you.

Fake Tokens and NFTs: Beware of poisoned gifts

In the exciting world of cryptocurrencies, receiving unexpected tokens or NFTs might seem like a godsend. However, be careful: sometimes scammers sendunsolicited tokens or NFTs to your wallet, often accompanied by an offer that seems too good to be true.

These digital assets can bea Trojan horse in disguise, tricking you into signing a transaction that will open the doors of your wallet wide to thieves.

Take the example of afake airdrop: you suddenly find brand new tokens in your wallet with an instruction to exchange them for a more established cryptocurrency. You follow the process, and without you knowing it, by approving this transaction, you are giving the green light to scammers to drain your funds.

Read Also: The Future of Finance: Cryptocurrency’s Impact On the Global Economy

Likewise, attractive NFTs can be used as bait to lure you into visiting fraudulent websites thatwill siphon off your cryptosas soon as you enter your private keys.

How to avoid falling into the trap of Fake Tokens and NFTs?

First, be skeptical of any digital assets received for no apparent reason. Do not click onany linksor follow any accompanying instructions without doing your homework. Always check the legitimacy of these tokens or NFTs by researching them on recognized platforms .

If you did nothing to receive them, why would they be given to you? It’s crucial to understand that in the crypto world, unexpected gifts are oftena trap. By being careful and checking, you can prevent these poisoned gifts from stealing what’s yours.

Viruses and Malware: When software turns into a nightmare

When we talk aboutviruses and malware, we usually imagine a spy film where hooded hackers infiltrate the most secure systems. In reality, it’s a bit like that, but for your crypto portfolio, it’s above all a major risk.

This malicious software can slip onto your computer or smartphone and, like parasites, cling to yourmost confidentialinformation . Before you even know it, they can misappropriate your cryptocurrencies by exploiting your slightest oversight.

Imagine for a moment that you download what appears to be a legitimate app for managing your cryptocurrencies. You install it, everything seems to work like clockwork… except that, lurking in the shadows, a security vulnerability allows strangers to monitor your keystrokes.

Goodbye discretion when enteringyour passwords or private keys!Another equally common scenario: You receive an email asking you to click on a link for a crucial update or important document to review. You click, and it’s the door open to all windows for malware.

So how do you keep your devices clean and secure?

Start with the basics: update your operating system and applications regularly. An up-to-date system is a much more difficult fortress to storm. Stay away fromquestionable downloads and suspicious attachments.

If you’re not sure of the source, don’t risk it. And for an extra layer of protection, consider using a trusted antivirus and, why not,a virtual private network (VPN)to cover your tracks.

Don’t let complacency open the doors to your digital life. Be proactive in securing your devices, and you’ll prevent your valuable cryptocurrencies from falling into the wrong hands.

The Pump and Dump in Crypto: Don’t let illusions inflate

Pump and Dump maneuvers are formidable stratagems in the world of cryptocurrencies. They are like afinancial roller coaster: first, a dizzying climb where everyone is clinging to their seats, convinced that the peak is near, then a sudden free fall, leaving investors with empty pockets and heavy hearts .

In these well-oiled crypto scams, the organizersartificially inflatethe price of an asset before selling it at a carefully orchestrated spike, leaving the latest arrivals in complete disarray.

Let’s take a striking example:crypto X, which has experienced a meteoric rise, supported by aggressive promotional campaigns on social networks. Influencers praise its merits,Telegram groupsare agitated, and you let yourself be convinced that it is the investment of the century.

But once the instigators sell at the top,the price collapseslike a house of cards under a fan.

How to stay away from Pump and Dump?

First, cultivateskepticism. If a cryptocurrency soars for no fundamental reason, be wary. Do your own research and don’t get caught up in the mass hysteria.

Tracktrading volumes and be alert for massive sell signals. And remember, if it’s too good to be true, it’s probably an invitation to a prom that might just end in a pumpkin patch.

Romantic and investment scams

Online romance scams area sneaky form of crypto scamswhere lonely hearts are exploited. Scammers, experts in emotional manipulation, build relationships online and gain the trust of their victims before pulling out their game: a sudden emergency, an exceptional investment or a pressing financial need.

And before you know it, you’ve transferred your funds to a complete stranger.

Likewise,unsolicitedinvestment offers promising astronomical returns with zero risk should set off alarms. These promises of easy riches are often the setting for theaters of illusions where the main actors are the crooks.

To avoid this crypto scam, keep your feet on the ground!

Implement strict rules for your online interactions. Never mix your love life and financial decisions,especially with strangers. Also be wary of unsolicited investment offers.

Before committing your cryptocurrencies, ensure the credibility of the offer and seek external opinions. Remember, when it comes to your investments, your head should lead your heart, not the other way around.

Ponzi schemes and MLM crypto scams

Ponzi schemes and MLMs (Multi-Level Marketing) in the world of cryptocurrencies are wolves in sheep’s clothing, promising wonders with astronomical returns.

Their stratagem is simple but formidable: use the money of newcomers to reward those at the top of the pyramid. But like any pyramid built on sand, as soon as the influx of new investors dries up,it collapses, taking with it the hopes and savings of the majority.

Take the example of the famous“Bitconnect”, which has become synonymous with crypto scam. Touted as a revolution in the world of cryptocurrencies, it offered exorbitant daily returns. But when the veil was lifted, it revealeda classic Ponzi scheme, leaving behind a trail of disappointment and financial loss.

How to avoid the quicksand of Ponzi and MLM?

The key is vigilance and education. Be wary of projects that promisedisproportionate returns on investmentwithout a clear business model. Find information about the project founders and their history.

Be especially careful with projects that focus on recruiting other members to make gains. Remember, in the world of cryptocurrencies, if something seems too good to be true, that’s probably because it is.

The Fake Crypto Trading Bots Scam

In the digital age of cryptocurrencies, trading bots have become popular tools for automating investment strategies. However, with the rise of this technology, a new form of scam has emerged:the fake trading bot scam.

Thesemaliciousprograms are presented as silver bullets for maximizing your crypto profits, but in reality, they are only designed to do one thing:siphon off your assets.

The trick is often well practiced: you come acrossan advertisement or a poston social networks extolling the merits of a revolutionary trading bot with testimonials and proof of attractive gains. Excited at the idea of multiplying your cryptos, you download the software. But once activated, instead of trading in your favor,the bot diverts your fundsto scammers’ wallets.

How to avoid falling into the trap of Fake Trading Bots?

To avoid this crypto scam, exercise extreme caution. Before entrusting your cryptocurrencies to a bot,check its authenticity. Seek independent reviews and check the credibility of sources. Be wary of promises of quick and easy profits.

Remember that in trading , as in life,there are no shortcuts to success. If you choose to use a bot, opt for reputable and transparent solutions, and even then, stay vigilant.

FAKE ICOs in Crypto

Initial Coin Offerings ( ICOs ) have been a revolution in the financing of blockchain projects , providinga new avenue for raising funds. However, like any innovation, ICOs also have their dark side: FAKE ICOs.

These deceptive offers, dressed up with lofty promises, are in realitytrapscarefully designed to divert funds from enthusiastic investors.

In a FAKE ICO, everything is often done to convince:a sophisticated website, an impressive white paper, and even a team of “specialists” with reassuring profiles. But make no mistake: behind this facade, there is no real project, no intention to produce a functional product.

The infamous example of “ The DAO ”, although technically not a FAKE ICO, illustrates the risks associated withinsecure and poorly structured projects, leading to significant losses for investors.

How to detect and avoid FAKE ICOs?

The golden rule is caution. Before investing,take the time to do thorough research. Checkthe credibilityof the team behind the project: do they have a verifiable online presence? Is their history transparent? Examine the whitepaper: is it realistic and detailed? Also check the presence of smart contracts and their audit by trusted third parties.

And above all, pay attention to feedback from the crypto community onforums and social networks. Remember, if an ICO seems too promising to you without solid foundations, it is better to move on.

Exit Scams in Crypto

Exit scams in the cryptocurrency space are scam tactics where the developers of a project suddenly disappear with investors’funds. This type of maneuver is particularly sneaky, because it plays on the trust established over time.

Investors then find themselves with abandoned projects and significant losses. An example of an exit scam is that of the “XXX” project, where the founders, after raising substantial funds, turned off all communication channels and disappeared, leaving investors in disarray.

How to prevent this crypto scam?

Pay attention to the transparency of the projects in which you invest. Check the backgrounds of team members and closely monitor the progress of the project. Be wary of sudden changes in direction or broken promises.

Regular and transparentcommunication is a good indicator of the reliability of a project. Always stay alert and ready to reconsider your investment if warning signs appear.

Unravel the underside of crypto token allocations

Token allocation deception in cryptocurrency projects is an unfortunately widespread practice, where developers manipulate token distribution fortheir own benefit.

These actions, often hidden behindpromises of transparency, can distort the value of the token and harm investors.

These deceptions take different forms, such as withholding a significant proportion of the tokens for the development team orsecretly issuing additional tokens, which dilute the value for existing holders.

For example, a project could announce that only 10% of the tokens are reserved for the team, when in reality,a much larger shareis secretly allocated.

How to foil Token Allocation deception?

The key is in due diligence. Before investing, examine the tokenomics of the project in detail: how much of the tokens are allocated to the team, advisors, and how much is reserved for public sale? Also checkfor token lock-ups that prevent the team from selling their shares immediately.

Stay tuned forproject updatesand announcementsregarding token allocations. Finally, follow discussions in the community to gather diverse opinions and detect possible inconsistencies.

Our final words on crypto scams

The cryptocurrency space is a breeding ground for scammers,where old scams give way to new, more elaborate tactics like “ rug pull ,” where developerssuddenly withdraw all funds from a project, leaving investors with substantial losses.

The methods vary, but the exploitation of human emotions remains constant: fear which precipitates decisions,the greed which blinds, and the lack of knowledge which exposes one to risks.

The best defense in this digital world iseducation and vigilance. A thorough understanding of cryptocurrencies and constant monitoring are essential to thwart scams.

Remember, even a small mistake can havemajor consequences. Be careful, especially when faced with overly tempting promises.

You can adopt strong security measures to protect your digital assets:

- Enable two-step verification (2FA) on all your cryptocurrency accounts.

- Consider using a hard wallet for added security, especially for large amounts of crypto.

- Be careful with links and attachments in emails or messages, and always verify the authenticity of websites before entering your information.

- Keep your software and operating systems up to date to protect against security vulnerabilities.

In this modern gold rush of cryptocurrencies, where DeFi arouses interest and desire,informed distrustis your best ally. Always remember: once your digital assets are gone, it’s often too late to act. Keep a critical eye andstay informedto avoid falling into the traps of scammers.