Top 5 Payroll Software for Small Businesses – Small business owners face different challenges, not necessarily the same size as corporations and businesses, but in many ways they are similar.

However, in the eyes of the tax collector, any form of business can file and/or file feedback, so small businesses that fail to do so face penalties in the form of fees or fines, including wage errors.

However, working on the payroll system takes a lot of time, a lot of time and energy is spent on understanding it, but companies decide to use payroll services so they don’t have to worry about errors or legal errors and save time.

If you are looking for a payroll service for your business, take into account the price, key features and functions, as well as whether there is a free product trial and demos available so you can test the commissioning and see if it suits your needs.

Here is a list of the best small business payroll Software to keep their taxes, benefits, and other withholding calculations correct down to the penny.

Table of Contents

The best Windows 10 payroll tools

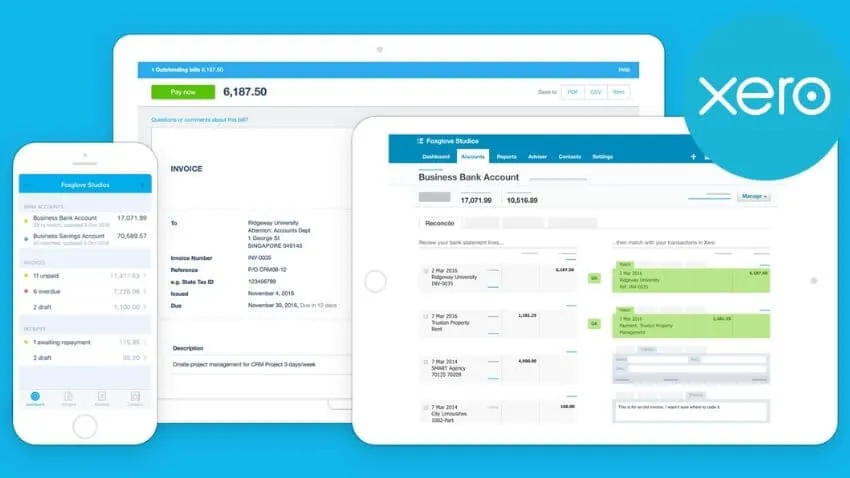

1) Xero

It is an award-winning cloud accounting software that is used in over 180 countries around the world and is intended for small and medium-sized businesses.

Features include billing, inventory management, bank reconciliation, expense and bill payment management, project tracking, multi-currency capability, business performance dashboard, sales tax calculation, and mobile applications among others.

What’s unique about this small business payroll software is that it processes and maintains payroll while automatically adjusting taxes.

It is also very secure, thanks to numerous approvals and two-factor authentication, so fraud is minimized and each transaction contains detailed information such as dates, users, actions taken and notes.

With Xero, you can get a summarized report of your financial activities and keep detailed records of all transactions, including tax status, approved bids and purchase costs.

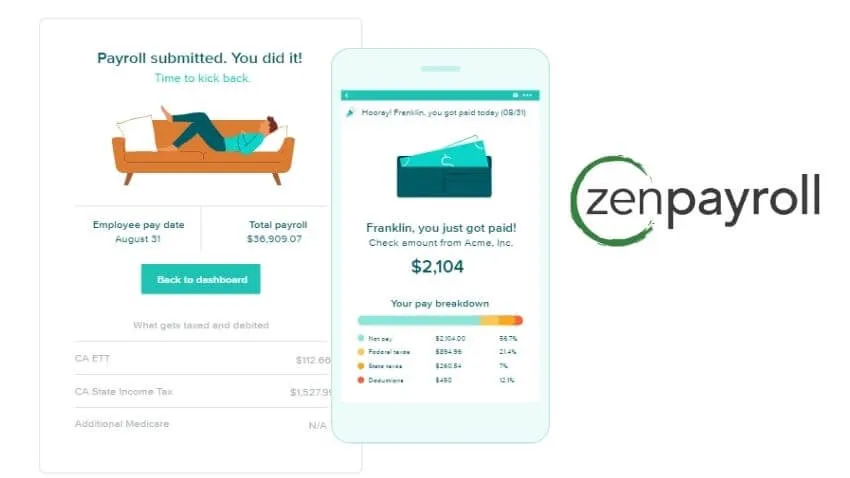

2) ZenPayroll

Formerly known as ZenPayroll, this tool is cloud-hosted software that combines payroll, benefit management, human resources, and compliance functions in one simple package.

The software is designed for small businesses looking to manage payroll and human resources needs and copes with it by streamlining and automating the calculation, payment and remittance of payroll taxes while ensuring a full company claim to avoid critical errors.

It also doubles up as a team management HR solution without all paperwork, emails and spreadsheets, and syncs all employee data.Its advantages include the elimination of human error, full compliance with HIPAA, ACA and ERISA standards.

While automatic data checking to prepare reviews, send notifications and maintain employee privacy.

It also simplifies benefit management, labor tax reporting, payments, employee insurance and budget plans, and manage them, and you can easily set up and / or manage 401 (k) plans.

You are also not stuck to using it, and you can test it with a one-month free trial to see if it fits your business well.

3) Sage Intacct

This accounting software is based on the merger of the Sage Group and ERP solutions that acquired Intacct, a 19-year-old software accounting firm.

This combination brings together Sage’s expertise, experience and world-class quality to create Sage Intacct, a comprehensive accounting and payroll system.

With this small business payroll software, you can manage cash, purchasing, invoicing, vendors, revenues, contracts, projects and funds, inventory and subscriptions, as well as generate financial reports, via the cloud system.

It is both flexible and accurate in its quest to improve the company’s performance and employee productivity over the long term.

Benefits of using this tool include HR accounting that covers aspects such as payroll, benefits, time tracking and insurance, thanks to a single, interconnected payroll system at different locations that gives you an insight into the pay structure, its performance and activities.

It is also recognized by the AICPA (American Institute of Certified Public Accountants) as a leading provider of financial applications with numerous industry awards for its belt.

In addition, it has a wide range of accounting capabilities, and using the built-in report templates, you can create customizable reports, analyze company performance, track sales and much more.

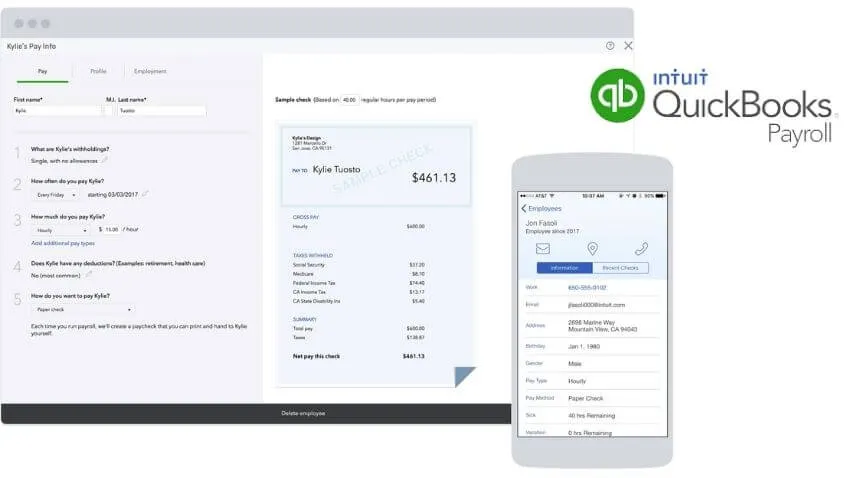

4 Intuit Payroll

Used by over a million companies worldwide, Intuit Small Business Payroll software is one of Intuit’s best products, in addition to the famous QuickBooks and TurboTax.

This platform provides a hassle-free payroll management solution for small businesses and allows accountants and owners to pay efficiently with high accuracy, while automating calculations such as tax and generating payouts.

Being part of Intuit’s accounting software, it integrates with QuickBooks to provide a more reliable accounting system, thereby improving cash flow, ensuring that employees are paid appropriately and accurately.

In addition to payroll, this software offers employee management tools to hire top talent and to comply with and comply with labor and employment laws.

Its benefits include easy and fast payroll management, free payroll calculator for hourly workers and salaries, world-class support, as well as automatic payroll creation when hours are entered and/or employee salaries are approved.

5 OnPay

This small business payroll software doesn’t have advanced features and extras like the others listed here, but its pricing model is simple and offers simple needs for small businesses.

Among its features are unlimited withdrawal runs, tax premiums, deposits and check printing, as well as a mobile-friendly system that is easy to use and fast.

You can get your payroll up and running in minutes and its simple interface makes entering payroll items such as hours, tips, bonuses and returns done in the park.

It also has fast loading times even for mobile phones and tablets, and you also have a preview pane to see your payout flow to avoid fatal errors that could result in taxpayer penalties.

Other things it can do for you include indemnity insurance and insurance as the software is a licensed health insurance broker with 401 (k) plans fully integrated.

You can also perform HR functions such as self-join employees to save time, automatic reports of new hires for the government on your behalf.

Lifetime accounts that employees have to access to long after they leave the organization, online access for employees, guaranteed payroll compliance and automated income taxes.

It also works with any type of employee, and if you or your employees prefer direct deposits, prepaid debit cards or running your own checks.

You can pay at no extra cost. If you need assistance, OnPay’s Certified Payroll Professionals are on hand to assist you over the phone.

Hopefully, you are like this Top 5 Payroll Software for Small Businesses and we are always open to your problems, questions, and suggestions, so feel free to Comment on us by filling this.

This is a free service that we offer, We read every message we receive. Tell those we helped by sharing our posts with friends